- IT/MSP Entrepreneurs

- Posts

- IT MSP Entrepreneurs is back on Beehiiv

IT MSP Entrepreneurs is back on Beehiiv

IT/MSP Entrepreneurs Newsletter

May 11, 2023

Hey folks!

You haven’t heard from us in a week or two. Sorry about that.

We’ve been busy migrating our email provider to Beehiiv, it’s awesome.

Back to your regularly scheduled MSP programming and news

-Stetson

Weekly MSP and Tech News Roundup

MSP

We are seeing Kaseya rise to monopoly power. (me: checks Sponsors…ok cool)

Business & Economy

Artificial Intelligence

Miscellaneous

Sick and tired of managing printers? 🖨️

us too…

Dealing with print issues doesn’t have to suck.

Not convinced?

Print Partner is the trusted print vendor that hundreds of MSPs across the country introduce their clients to.

And for good reason.

Print Partner benefits their partners in a couple ways:

They pay $250 for every referral

They pay $1000 for every copier sold to a client

Print Partner protects MSPs from random print vendors who also offer MSP service

Print Partner has a non-compete, so they won’t steal your clients!

Print Partner also teams up with your MSP on installation provides ongoing support for your customers so they have a flawless experience. ✨

That means you can put your baseball bat back in your kid’s room.

Stop stressing.

Start getting paid.

Reach out to Print Partner today and stop hating printers.

Top Community Posts

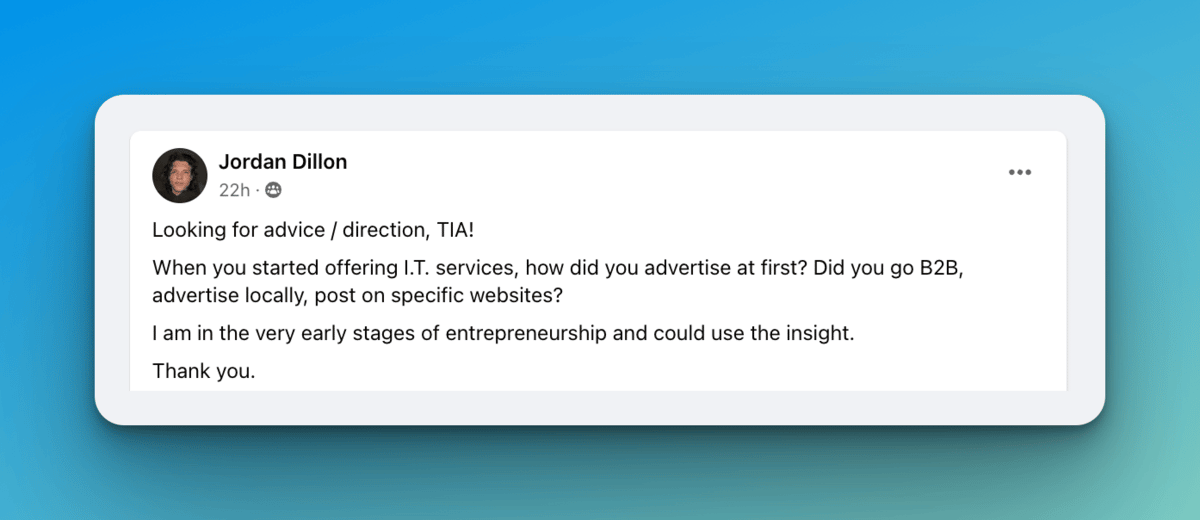

Top Posts from IT/MSP Entrepreneurs

The following has been pasted in it’s entirety, original posted by Jay McBain:

Any company that is building a serious, global go-to-market must consider distribution as a foundational building block of that strategy. Of the total tech/telco hardware and software purchased by businesses and governments around the world each year, distribution represents 25% of the total ($405 billion).

With the amount of consolidation and M&A activity in this space over the past few years, the Top 15 distributors now represent 64% market share. To round out the list, Canalys will be publishing a list of the top 500 global distributors later this year.

The year-on-year growth for the total IT distribution market in the previous year was 6.1%.

Some key insights:

1. Some distributors saw declines in US$ revenue due to local currency weakness against the US$, but many continued to see local currency revenue growth. Some major distributors saw declines as a result of ongoing geopolitical friction.

2. Distributors have seen growth shift to high-value technologies, including cybersecurity, software and infrastructure (as supply improves), while consumer business and client devices have declined. Volume distributors are refocusing on “value” distribution for growth.

3. Distribution is undergoing a fundamental transformation with the move to SaaS, subscriptions, cloud and marketplaces. Distributors will act as orchestrators of multi-partner ecosystems as partners increasingly play specialized roles within complex solutions delivery.

4. Specialist distributors in cybersecurity, networking and cloud are outperforming volume players and expanding rapidly through both organic growth and M&A activities.

Also, of important note, the majority of these top distributors (at the CEO level) will be at the Canalys forums this year in Q4 - Barcelona, Palm Springs, and Bangkok. https://canalys.com/events

How did you like today's newsletter? |